Gun sales tax calculator

Tax fraud involves intentionally trying to deceive the IRS. The Sheriffs Office of the City and County of Philadelphia is committed to service procedural justice and the sanctity of human life.

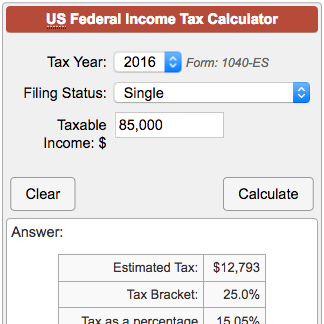

Tax Return Estimator Sale 52 Off Www Wtashows Com

A sales receipt is for products that are sold by a vendor to a customer.

. This guide is not designed to address all questions. Get a great deal on a great car and all the information you need to make a smart purchase. How much you may save with tax credits discounts.

566 Thermal Gun Infrared Contact Thermometer Rated 5 out of 5 by noweeds from Great teaching tool I use the infrared thermometer with my 4-H Club and demonstrations. A Must-Read book for all Americans in 2022 Does God Love the Wealthy More Than the Middle Class covers various socio-economic issues such as tax for the modern adult - 21 mins ago. Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United StatesSales tax is governed at the state level and no national general sales tax exists.

The sale lease storage use or distribution of any of the following are exempt from sales tax. Local sales and use taxes are filed and paid to the Department of Revenue in the same manner as the state sales and use taxes. For calendar year 2020 interest was charged at the rate of.

A sales tax holiday is a limited time period during which some normally taxable products are exempt from sales tax. To determine when youre eligible to renew you may contact FDACS at 850 245-5691 or use a date calculator. Texas Sales And Use Tax Resale Certificate And Certification 01-339 Step 7.

In addition OpticsPlanet reserves the right to change this policy as needed. These laws are subject to change. The second page is a certification form.

Visa Mastercard AmEx to start categorizing gun shop sales. From stock market news to jobs and real estate it can all be found here. At the top of the page give the name address and telephone number of your business.

Get breaking Finance news and the latest business articles from AOL. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. For calendar year 2022 for all taxes except Real Estate Tax and Liquor Tax interest is charged at the rate of 5 per year 042 of the unpaid balance per month.

This also includes a general listing of items that are exempt from the Massachusetts sales and use tax. At last count more than 20 states will provide one or more sales tax holidays in 2022. Retail sales of gun safes and gun safety devices are exempt from sales and use tax July 29-31 2022 Back to School Sales Tax Holiday General apparel that costs 100 or less per item such as shirts pants socks shoes dresses etc.

It describes the tax what types of transactions are taxable and what both buyers and sellers must do to comply with the law. The parcel tax will charge a small amount for undeveloped land and a slightly bigger amount for developed land in designated neighborhoods. Payments giants to apply new code identifying sales at US.

These EVs now qualify for tax credits under new inflation law While some requirements dont kick in until 2023 any cars bought after August must be made in North America. The term commercial is used to distinguish it from an investment bank a type of financial services entity which instead of lending money directly to a business helps businesses raise money from other firms in the form of bonds debt or share capital equityThe primary operations of commercial banks include. As of December 2014 the state removed the requirement for gun dealers to collect sales.

Sales taxes are levied by the State and on a county by county jurisdiction. The Tax Foundation is the nations leading independent tax policy nonprofit. 45 states the District of Columbia the territories of Puerto Rico and Guam impose general sales taxes that apply to the sale or lease of most goods and some services and states also.

County B has proposed a new parcel tax which will add a new tax onto the current property tax. Gun stores By Reuters - Sep 10 2022 3 More News FAANG 20. Sales tax calculator Get free rates.

The ability to show the difference in temperature of light bulbs comparing incandescent florescent CFL and LED lights. For calendar year 2021 interest was charged at the rate of 5 per year or 042 of the unpaid balance per month. Depending on the item being sold and the location of the transaction a sales tax may be placed.

Texas Sales And Use Tax Resale Certificate And Certification 01-339 Step 8. Machinery tools and equipment and repair parts for them. Sales tax if any is charged based on the applicable state and local sales tax regulations and rates.

All local jurisdictions in Tennessee have a local sales and use tax rate. This guide includes general information about the Massachusetts sales and use tax. Find new and used cars for sale on Microsoft Start Autos.

The most common tax crimes are tax fraud and tax evasion. The receipt is usually comprised of the number of items quantity multiplied by the price per unit. Renewal process When you arrive for your appointment an associate will take your picture collect your payment and electronically submit your renewal application to FDACS.

Washington firearms dealers also must collect sales tax on interstate gun transfers by a licensed dealer. The local tax rate may not be higher than 275 and must be a multiple of 25. Inflation Reduction Act savings calculator.

Our duties encompass protecting the lives property and rights of all people within a framework of service uncompromising integrity fiscal responsibility professionalism vigilance and bias free conduct. Tax evasion occurs when you willfully attempt to evade taxes. Sales tax calculator Get free rates Tool.

OpticsPlanet withholds sales tax as required by law. Sales tax holiday for gun safes and gun safety devices July 1 2021June 30. Say Hello To MATANA And Developments In Apples New.

This page is for personal non-commercial use. Actions That Can Land You in Jail. You may order presentation ready copies to distribute to your colleagues customers or clients by visiting https.

Give the name and address of the retailer you are making a purchase. A commercial bank is what is commonly referred to as simply a bank. When one views the tax bill like this it makes paying for infrastructure manageable.

Tax fraud is different than a taxpayer being confused by the tax form or placing numbers in the wrong line. The local sales tax rate and use tax rate are the same rate. Materials supplies and packaging materials for making beer are not subject to sales tax when purchased by a licensed brewer.

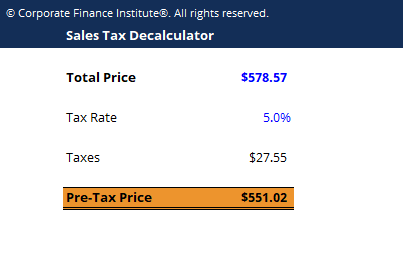

Sales Tax Calculator Taxjar

Sales Tax Calculator Taxjar

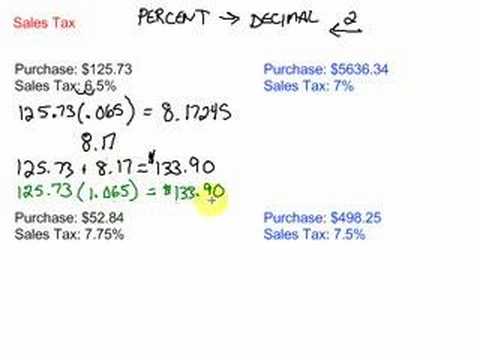

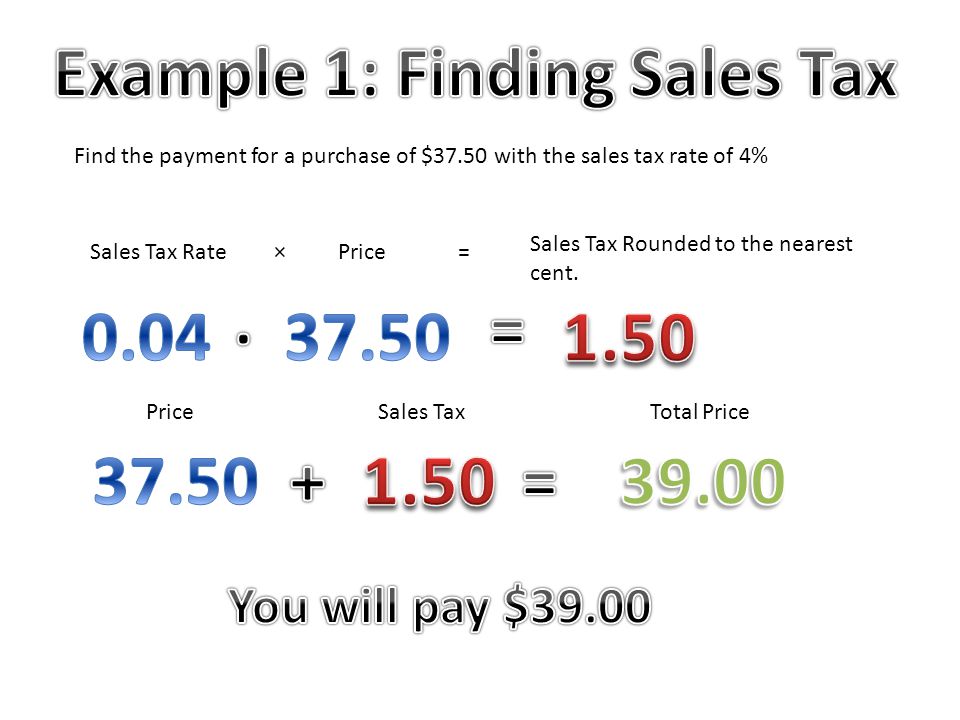

How To Find Sales Tax Flash Sales 59 Off Blountpartnership Com

How To Find Sales Tax Flash Sales 59 Off Blountpartnership Com

Sales Tax Calculator Taxjar

How To Find Sales Tax Flash Sales 59 Off Blountpartnership Com

Sales And Use Tax Rates Houston Org

Sales Taxes In The United States Wikiwand

How To Find Sales Tax Flash Sales 59 Off Blountpartnership Com

How To Find Sales Tax Flash Sales 59 Off Blountpartnership Com

Sales Taxes In The United States Wikiwand

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

How To Find Sales Tax Flash Sales 59 Off Blountpartnership Com

How To Find Sales Tax Flash Sales 59 Off Blountpartnership Com

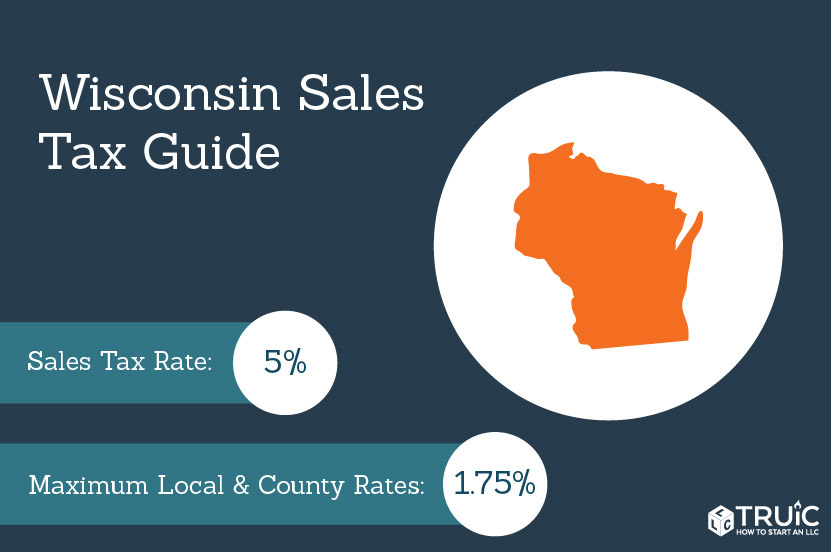

Wisconsin Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Shopping Calculator With Tax Apps On Google Play